What a weekend to be locked out of your own blog account! A bit of a grab bag of thoughts here – sorry for some repetition….

Silicon Valley Bank has taken us from from “higher [rates] for longer” to “not much higher for not much longer.” Why?

- The Fed’s original and first priority (since 1907) is to safeguard the banking system. Inflation (since 1977) comes second. Employment is a distant third. The 2% inflation target just barely turned 20 (2012).

- The first canary just died in the banking system… Note that Commercial Real Estate is 24% of on-book bank loans and also showing serious stress from high rates. The labor market is showing NO signs of stress.

- The banking system (and commercial Real Estate) will blow up before the labor market does. The labor market probably wouldn’t soften quickly even if the Fed hiked to 7%. Even 6% might spell disaster for the banks and a building re-finance.

If they keep on hiking and hold for longer, Powell goes down in history as “the guy who blew up the finance and real estate industry in a quixotic, ill-judged attempt to bring down inflation driven by supply/demand factors out of the Fed’s control” Arthur Burns #2… Not Paul Volker. Powell does not want that to be on his gravestone.

Even if Powell wanted to grit his teeth, he will be fighting a rising tide of anger and fear from a lot of very influential people. Look at the howl of protests and entreaties from “libertarian” Silicon Valley after SVB went under. Libertarians do tend to assume the little people will pay the Price of Liberty (NB – there are very few low-income libertarians).

- Fed tightening cycles are breath-holding contests.

- The labor market is “supposed” to gasp for breath first. But it is doing great. See Feb jobs report.

- SVB is the first gasp for breath. There are a lot more “mark to fantasy” assets sitting out there that can’t stay that way for much longer. Rate bets (like at SVB) and precarious Real Estate assets facing re-financing risk. Higher rates endanger both.

- If the Fed is going to damage the economy until it slows, that damage is going to hit people who are used to getting taken care of (see “Silicon Valley Bank Depositors”). The Fed would permanently impair a lot of wealth before that ever trickles down to the labor market.

- Paul Volker did not get his Wall Street sainthood by “impairing a lot of wealth.”

In sum – the labor market looks too healthy and the financial system too shaky to do “higher for longer.” So we hike a bit to save face. Then find a way to justify ~3% inflation. 3% being, BTW, totally fine.

So the collapse of Silicon Valley Bank puts an end to this tightening cycle.

Moreover, the fed will have to cut rates sooner vs later to get short-term 1-2-year rates (where the Fed has more influence) down below 10+ year long-term rates (where the free market sets prices more then the Fed does).

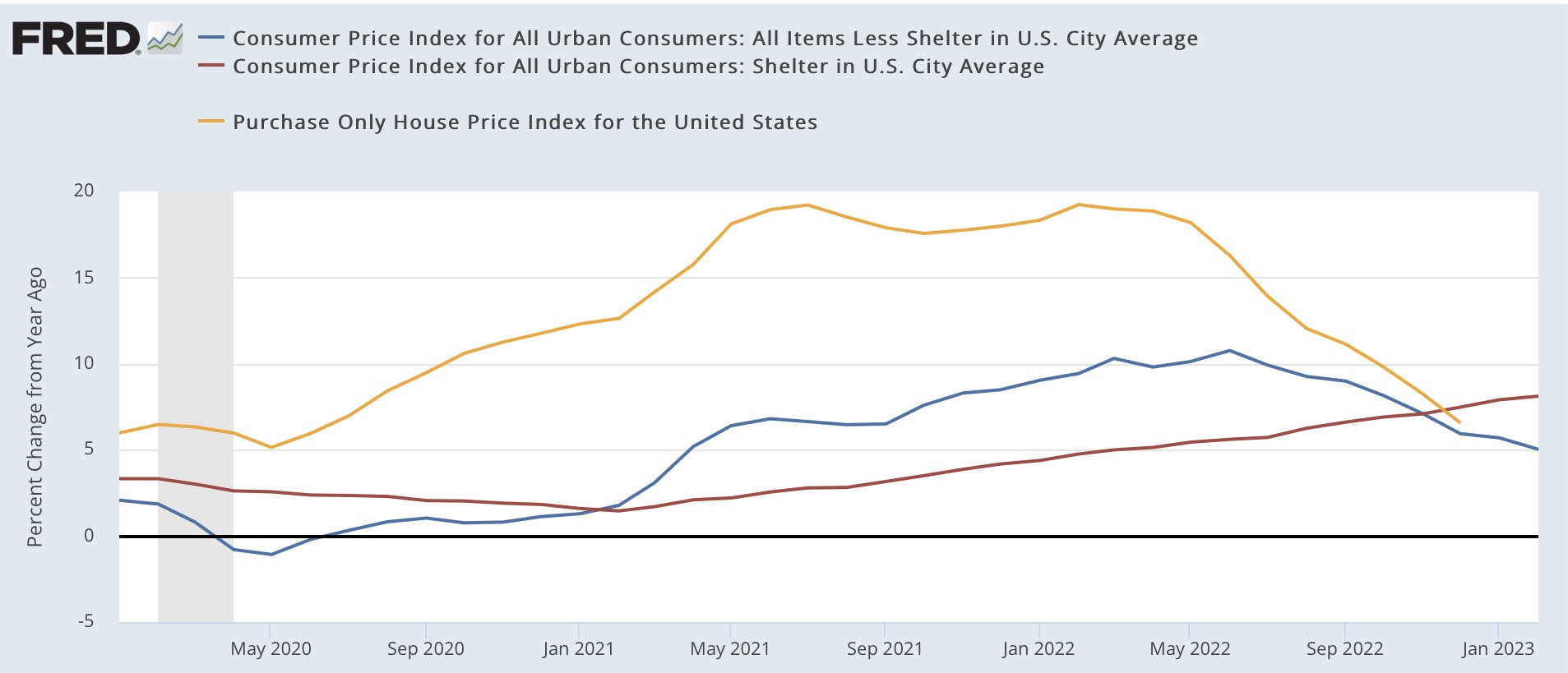

Will the Fed have slain inflation? No. We have no counter-factual, but it is pretty obvious the whole tightening exercise didn’t do much to change the course of the real economy. The cause of the inflation was in the real economy – supply demand shocks – and the cure will be in the real economy too. As the line goes “the cure for high prices is… high prices.”

Anyone with real faith in free markets would have told you that 18-24 months ago. There is a stack of academic research that has long explored the limitations of the Fed’s powers. But Wall Street types believe more in rules of thumb than in fancy academics – especially if those academics are even a teeny weeny bit to the left. No matter that MMT has laid out a very robust framework for understanding the current inflation. The rule of thumb was… “The Fed is all powerful. They will crush the economy. Unemployment will soar. The great Oracle Larry Summers has told me so….!” We’ve seen that on front pages for 18+ months now. Even as the contrary evidence has steadily piled up. Until SVB went BOOM!

So the Fed fired its big bazooka. 4.5 percentage points of rate hikes later, the real economy has gone lumbering indifferently along. But the banking system just had a near-systemic crisis.

Never forget that the Fed was created/empowered to protect the banking system after the panic of 1907. That mandate was strengthened after the Great Depression. 90% of what the Fed does ever day is herd, manage, and protect the banking system. The banking system is also most Fed staffers’ revolving door employer when the retire.

That “control inflation” mandate? It didn’t get formalized until 1977. The “set in stone” 2% inflation target? A creature of Ben Bernanke in 2012. The Fed cares about the banks first, inflation second, and full employment by lip service only…

The Silicon Valley Bank crisis was unique. But dismissing the risk signal on those grounds is like arguing this particular dead canary was a little odd, so we don’t need to get the hell out of this coal mine before the toxic gases build up and blow. he canary is still dead and others will soon follow. The Fed knows this. The Fed will act accordingly.

The Fed still probably raises rates in the next meeting to save face. But this tightening cycle is done. They can’t keep raising for long. Nor can they keep rates at the current level.

Why? An inverted yield curve is kryptonite for banks and all sort of other financial markets players. A week ago, the 2 year Treasury rate was at ~5% and the 10 year rate was at 4%. Simplifying drastically, that meant were paying deposit rates tied to that 5%, but earning loan/asset tied to that 4%. Losing 1% a year is a path to insolvency. The reality isn’t that simple, but an inverted curve still leads to bankruptcy or… bank runs.

This week, the 2 year had tanked almost a full point to 4.3% and the 10 year has only gone down to 3.7% from 4%. Why? Because the market sees the Fed can’t tighten much more for much longer. Banks can hold their breath for a while, but they can’t hold their breath indefinitely. They can’t outlast the labor market.

The labor market just keeps chugging along. It isn’t going to crack soon enough for the Fed to save face. Not before another of its bank canaries die.

Have we slain inflation? Nope. Fed was never that powerful to start with. But do we naturally fall to something like 3%? Yeah probably. And 3% is (gasp) not really that different from the (arbitrary) 2% fed target.