Halfway through my first cup of coffee, the thought “I wonder what’s happened with Monetary Velocity?” flitted by. So I went and looked it up. Because that’s just how I roll. Besides, it was better than confronting the unpacking jobs that lies abundantly/expectantly/endlessly at my feet.

Monetary Velocity is one of those incredibly useful intellectual tools as long as you don’t try to get too precise or math-y with it. Roughly speaking it is how fast money moves through the economy. If you tracked a single dollar bill, how many times did it change hands? Another good short definition from Investopedia. “The rate at which money is exchanged from one transaction to another, and how much a unit of currency is used in a given period of time. Velocity of money is usually measured as a ratio of GNP to a country’s total supply of money. (http://tinyurl.com/kwkroyw and Wikipedia entry http://en.wikipedia.org/wiki/Velocity_of_money).”

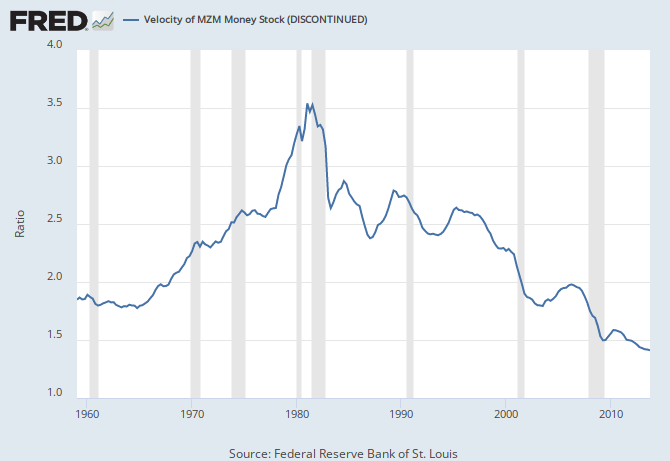

Currently, velocity (still) sucks. And the economy will probably suck until we find a way to get it back up again. See chart below. There are a few (complementary) drivers to higher velocity.

- Inflation: If money is going to be worth less in the future, people tend to spend it faster now.

- Income Redistribution: If you give a dollar to an unemployed person, they are going to spend it fast on food-shelter-fun. If you give that same dollar to a plutocrat, they are going to park it for a while and then “invest” it. With low interest rates and even lower animal spirits, those invested dollars are moving kind of sluggish these days. And whole lot of it is basically parked.

- Those darn Animal Spirits again: If people feel good, they spend more freely. Which makes other people feel good. Which makes them spend more freely. Which gets things moving again. Which we desperately need.

Velocity has actually been losing, umm, velocity, since the 2000’s. You could argue this was due to lower inflation expectations (which sounds nice and serious and non-partisan). But inflation was “tamed” in the 80’s and 90’s. The main trend of the 2000’s was rising income inequality. More dollars “parked” in various places by the Mitt Romney’s of the world and fewer dollars re-circulated by the Walter Mitty’s. Of course we had some manic phases in there (Animal Spirits tends to trump all and what else would you call the mortgage/housing/lending boom and the Dot Com era?). But the chart also shows energy leaking out of the “real” economy’s market halls, workshops, and taverns as it is carted up the hill to gild the glorious-but-sterile halls of the plutocrat’s palaces. Trapped wealth is sluggish money. And we could a use a little more velocity these days.

The good news is that Animal Spirits are perking up again. I expect higher inflation as a necessary evil. So does the Federal Reserve although they won’t come out and say it (they should). But a lot more needs to be done on the inequality side. My personal benchmark is when a person can work a single job at Wal Mart without having to draw food stamps.

- This bothers me as a taxpayer (I end up subsidizing Wal Mart’s wage bill).

- It bothers me as a citizen (people on government aid don’t make for a healthy community).

- It REALLY bothers me as an economist (poor people spend money faster and we NEED money to move around more).

I think inflation and wage rebalancing are coming over the next decade. Not as fast as some think, but more likely than many would like/hope to believe. From an investing perspective, remember that hope is not a strategy.