Adam Tooze piece here inspired me to do a little blogging.

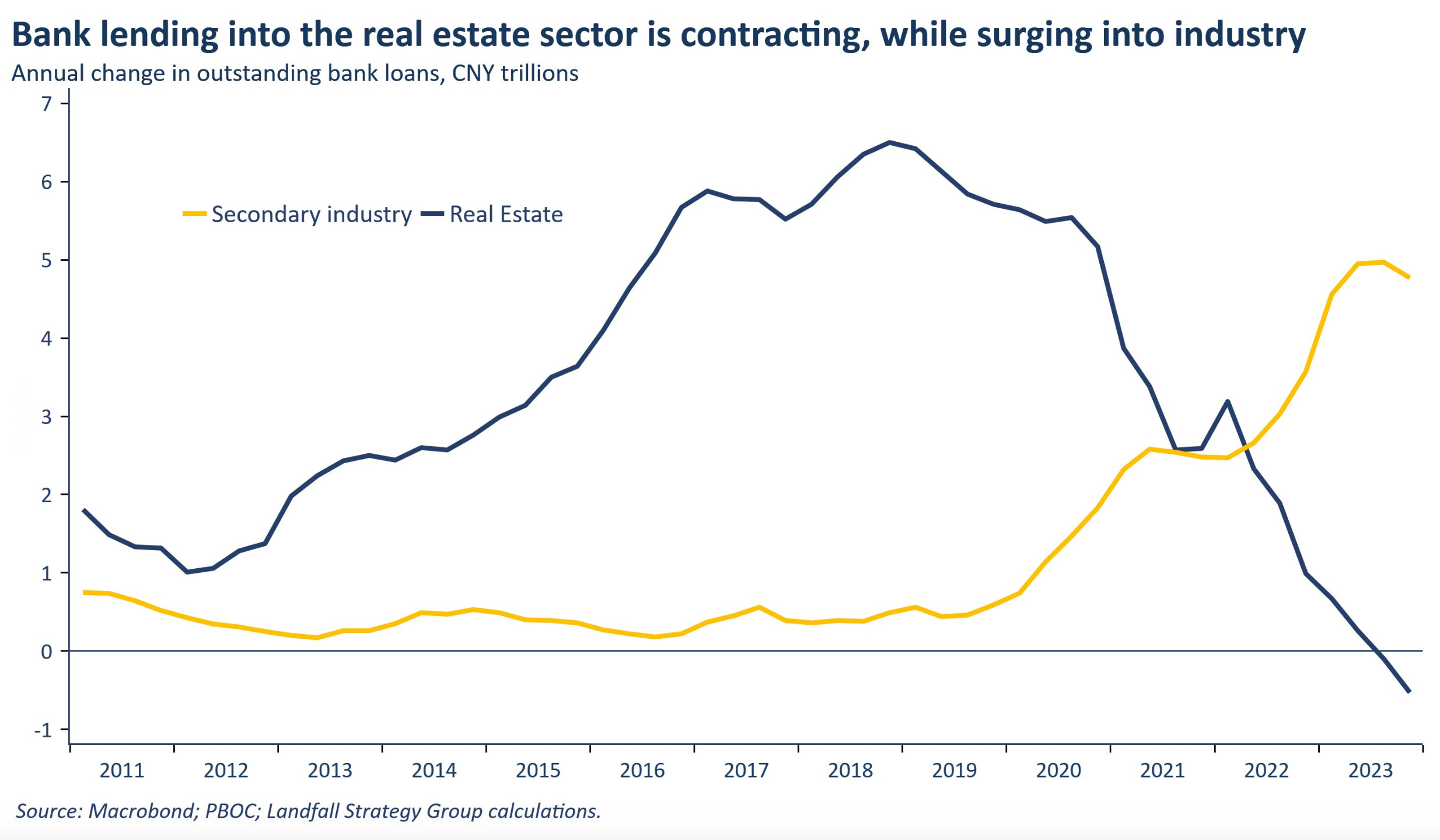

See chart below. All that Chinese industrial lending = goods deflation. China is (still) trying to export its way to prosperity.

This will be a persistent deflationary force until China either gives up or blows up…

Various people (Micheal Pettis especially) pointing out very few countries are able/willing to accept a permanent trade surplus. But that is what China is (still) trying to run with. That will hit developing countries and, likely, the US “consumer of last resort.”

A lot of that Chinese industrial lending is going to end up coming our way one shipping container at a time. Why? China’s consumers don’t claim a large enough share of national income to consume it. So the US will continue to run a “permanent” trade and budget deficit. Just how the math must work.

The Chinese alternative – driving up domestic consumption to absorb that production – would involve an internal income redistribution. They are unwilling to take on. That is why Pettis’ book is called “Trade Wars are Class Wars.” China has a Class conflict that is driving its Trade policy. Until either the upper classes accept the need to re-distribute income or some other factor forces the issue.

This is also why I am skeptical the global neutral interest rate R* has suddenly moved up. China’s surplus policies create excess supply and constrained demand on a global basis. That should(?) suppress interest rates, as we saw pre-Covid

That equation eventually gets solved. Hopefully the damage is mostly contained within China’s mostly-closed financial system. We’ll see? At least we’ll get a lot of cheap EVs and fridges out of the trade.

The other country highlighted in Pettis book is Germany. Their export-led model seems to have finally hit the end of its run. Not sure how to slot that into the above…

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F57e83a72-b5a8-421a-9824-f9347a99b87a_2468x1440.png